FaaSBank, Fern Software’s premier CRM and loans management system, was collaboratively designed with CFDCs (Community Futures Development Corporations) in Ontario, Canada. The software is now used by over 50 community and SME lending organizations from coast to coast to coast in Canada. User friendly and intuitive, FaaSBank assists lenders with many of their day-to-day processes, including:

- tracking client interactions

- business services and loan impact tracking

- loan management

- grant management

- flexible transaction processing (refinance and merge loans without any manual calculations!)

- full suite of grant, loan and transaction reports

- third party accounting integration for journal management (Sage/Simply, QuickBooks, AccPac)

- online loan application portal

From the very beginning of our interactions, one thing was clear – SMEs, in all their various shapes and sizes, require flexibility when it comes to loans and lending offerings. A loan product that suits a forestry operation in northwestern Ontario may be very different from what is required by a tourism provider on the shimmering easterly shores of Lake Superior.

With this mind, the FaaSBank design team strove to meet two primary needs:

- Make it easy to create regular amortization schedules for clients receiving standard term loans e.g. a specified monthly report amount over a set period of time; and

- Build in the flexibility to enable users to create fully customizable when and where required e.g. periods of interest only payments, periods of principal only payments etc.

We were able to achieve this by splitting the FaaSBank loan amortization calculator into two distinct parts: one to allow for the simple creation of standard schedules; and the other, what we called Schedule Scripts, to allow for creation of funky custom schedules.

The regular Calculator area is straightforward: a user defines the pertinent details of the loan they are making to the client, then clicks the Calculate button to generate and review the schedule.

In this window, a user will generally identify the following pieces of information:

Key Values

- Principal – the amount of money the client is receiving

- Amortization Term – the length of loan’s repayment period

- Payment amount – alternatively, if a payment amount has been agreed with the client, you can leave the Amortization Term field blank, and enter the payment amount into the Payment field. FaaSBank will then calculate the Amortization Term

- Interest Rate % – the interest rate to be charged on the loan. Depending on the selected loan product, this could be using a Simple, Compounded or Mortgage calculation method, and could have a Fixed or Variable interest rate applied.

Key Dates

- Disbursal Date – the date of the loan’s initial disbursement transaction i.e. when the client is to receive the money 💰💸

- Initial Payment date – the date of the first expected payment by the client. When the Payment Frequency = Monthly, all subsequent payments will fall on the same day of the month.

- Seasonal Options – this drop-down menu allows you to add a little spice to your regular amortization schedule. It can be used to specify an interest only period (e.g. the first six payments on the schedule), or a period where the payment amount will differ from the loan’s regular payments.

For example, let’s imagine our loan client is a creative sole proprietor in the Canadian Arctic who crafts and drafts heartfelt typewritten letters for people with a chronic case of writer’s block. Alas, during the harsh frostbitten winters, his antique typewriters freeze and misbehave, turning each keystroke into a near-impossible feat of physical strength and mental fortitude. Accordingly, rather than making their regular loan payment amounts, they request to make payments of only $200 during the months of December, January and February.

Such a scenario is a breeze with the Seasonal Options field: simply specify the months and the dollar value of the payments to fall within those months 🙌

Fees

The Fees section of the Calculator is only used if you are charging a loan fee (or fees) to your client. Fees can be capitalized onto the loan’s Principal balance, or charged as standalone non-capitalized fee amounts at the time interval of your choice e.g. one-time, monthly, quarterly or annually.

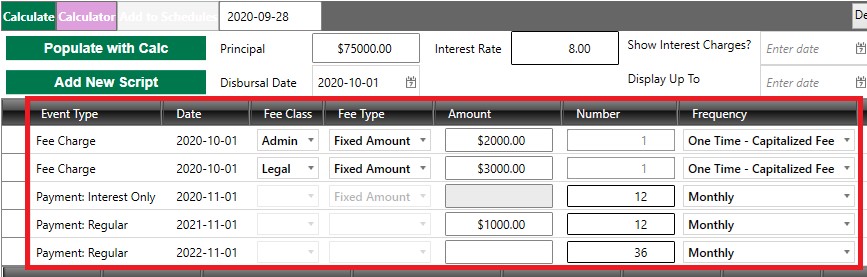

If the basic Calculator just won’t cut it, the Schedule Scripts feature allows you to craft fully customized amortization schedules to meet the exact needs of your client.

With it, simply add a new “script” row for each different action you want to appear on the generated schedule.

For example, in the screenshot below, our schedule is being concocted with five scripts:

- An Admin fee for $2,000, which is being capitalized onto the loan’s Principal balance

- A Legal fee for $3,000, which is also being capitalized onto the loan’s Principal balance

- 12 interest only payments

- Then 12 payments of $1,000

- And finally, 36 payments to full pay down the loan’s balance. The ‘Amount’ field has been left blank on this row, indicating that FaaSBank will crunch the numbers and calculate these payment amounts 🤓

Your generated amortization schedule will thus be bent to the whims of the most capricious clients:

When COVID wafted in, we really only had to make one significant change to the Calculator: updating it to accommodate forgivable loan portions. This was required for new loan programs such as the RRRF (Regional Relief and Recovery Fund) program being offered across Canada by the CFDC network. FaaSBank now tracks the amount of Principal paid down on these loans, and informs the user when they are eligible for any forgiveness amount.

And that’s it for our whirlwind tour of FaaSBank’s loan Calculator! Don’t hesitate to reach out to us at support@faasbank.ca if you have any questions about anything. Have a great day!