8 April 2021— Fern Software, an international Software as a Service (SaaS) Fintech solution provider since 1979, today announced the launch of their latest digital banking product Baytree. Baytree supports financial institutions such as banks, fund management firms, and small medium enterprise (SME) lenders in lending, portfolio management, and customer success.

The launch of Baytree comes on the back of an increasingly digitalised economy, enabling financial institutions to generate greater value by enhancing their digital offerings while ensuring customer success.

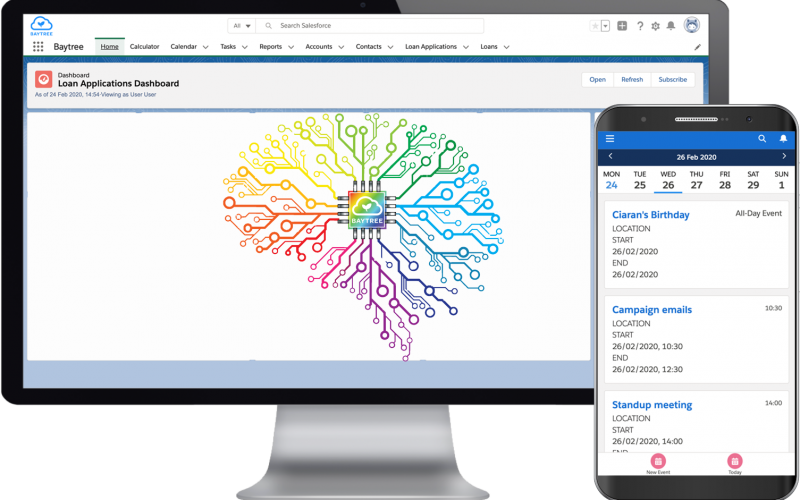

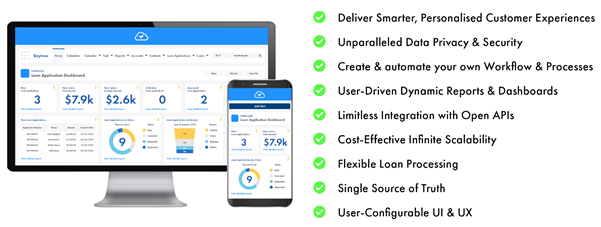

Powered by Salesforce, the world’s top Customer Relationship Management (CRM) platform, Baytree features a single integrated platform with limitless third-party integrations, as well as a complete set of artificial intelligence (AI) technologies to create smarter experiences for CRM, Credit Scoring, Knowing Your Customer (KYC), and Anti-Money Laundering (AML) detections.

Fitting seamlessly into each customer’s individual portfolio, Baytree consists of a highly flexible Loan Origination System to obtain instant loan calculations as well as personalise the grace periods and seasonal payments. Financial institutions can accelerate the loan tracking process with detailed information such as the breakdown and summary of each transaction. These details can be transformed into fully customisable dynamic reports instantly, removing the hassle and resources required for data gathering and manual entries.

As a cloud-based SaaS banking solution, Baytree has infinite scalability, making it suitable for a small team or a large organisation with over 500,000 users. As remote working becomes the norm, Baytree can ensure business continuity in financial institutions by empowering their customers to access the banking solutions anytime, anywhere. Baytree is designed to simplify processes and allow financial institutions to use a drag and drop interface without the need for any coding. Financial institutions can also depend on Salesforce’s robust security that complies with international standards to reduce personal data and security breaches to a minimum.

Fern Software’s Managing Director, John McGucken, commented, “Fern Software is excited to officially announce the launch of Baytree. Powered by Salesforce, it will provide us with greater agility and speed in supporting financial institutions in lending, portfolio management, and customer success. With more transactions occurring in the digital space, Fern Software strives to roll out innovative end-to-end solutions such as Baytree to revolutionise the FinTech landscape.”

To find out more about Baytree, visit https://fernsoftware.com/products/baytree.

About Fern Software

Fern Software is an international SaaS FinTech solutions provider incorporated in 1979 with a global presence of over 300 sites in 40+ countries, 3 million borrowers and regional offices in Amsterdam, Belfast, Singapore, India and Toronto, with 8 regional reseller partners.

We specialise in the development and implementation of digital and core banking systems with supporting modules to Banks, Assets / Fund Management, Digital Lenders, Microfinance institutions (MFI), Credit Unions, Savings and Loans organisations, SME Lenders, Development Banks, Community Development Financial Institutions (CDFI), Social Mortgages and a variety of grant funding agencies ranging in size.

For more information, visit https://fernsoftware.com/